The competitive landscape in the credit union sector has shifted dramatically in recent years, with a growing emphasis on enhancing user experiences. The surge in consumer expectations has laid a new foundation of necessities and obstacles for both financial organizations and fintech firms.

A top-tier, modern user interface has become almost a prerequisite for any new financial product or service. It’s no surprise, then, that credit unions are doubling down on their commitment to bettering member experiences, especially when confronted with the polished user interfaces presented by major banks and fintech companies.

Data from Business Insider reveals that in 2022, 61% of US banks considered enhancing customer experiences as a paramount objective. Simultaneously, Insider Intelligence found that for 81% of credit unions, improving member experiences was top of the agenda. There is a clear and pressing demand for solutions that amplify member experiences, but are credit unions harnessing the correct strategies to enhance their members’ user experiences?

Many credit unions might gravitate towards customer-facing tech solutions to bolster their user experience, yet there may be more impactful approaches to boost your members’ experiences. Most innovative efforts geared towards enhancing member experiences are focused on the front-end user interface of web and mobile applications.

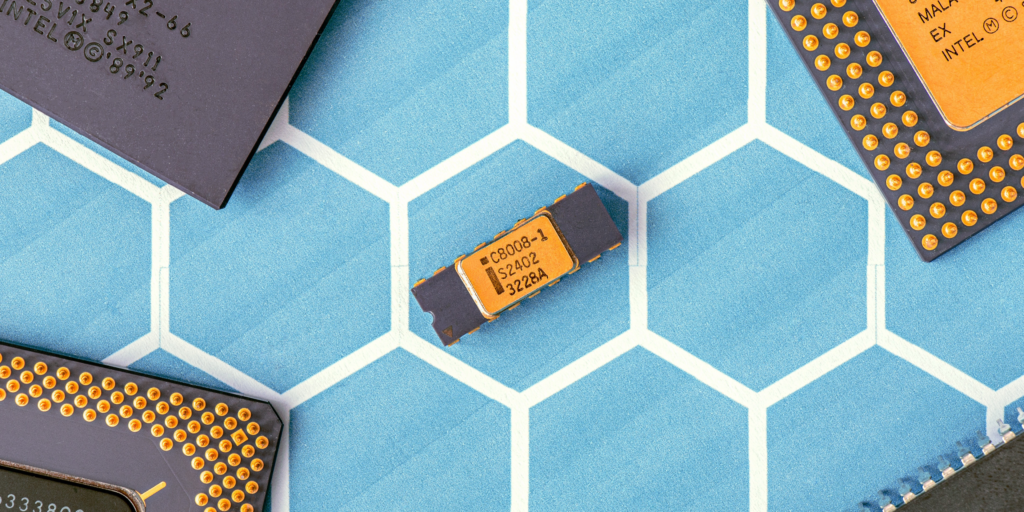

Nonetheless, refining the overall experience for members transcends a modern interface and calls for the integration of a well-coordinated back-end service fulfillment. For instance, credit unions could see substantial benefits from investing in back-office automation to speed up service delivery, and in data-driven processes that maintain high engagement throughout the transaction, setting their experience apart from others.

Consider the typical member experience when applying for a loan at a credit union. U.S. News & World Report notes that the average personal loan process takes approximately three to five days from interest to approval, while mortgageloan.com reports that an average mortgage takes close to 30 days. A large chunk of this time is spent on manual procedures requiring credit union professionals to connect with applicants to gather all necessary information and documents. Additionally, many credit unions still operate on legacy systems that don’t integrate or communicate with one another, resulting in a time-consuming process. How effective is a loan application that can be completed in five minutes, if it still requires several days of jumping through hoops to secure the loan?

This twofold inefficiency can lead to member dissatisfaction at the very least and can even push them towards other financial service providers offering better rates and services. On the contrary, implementing modern integration and automation solutions can drastically reduce the lending process from days to mere minutes, without the need to revamp existing systems. This type of transformation is invaluable for any financial institution, and the increased convenience directly benefits the member. Consequently, enhancing the back office becomes a vital step towards improving the service that your members receive on the front end.

This is not to dismiss the importance of member-facing solutions altogether. While front-end technology like online banking and mobile solutions undeniably serve as invaluable tools for financial institutions to elevate their services, credit unions must bear in mind that if their back-office solutions are not efficient, an appealing front-end user experience alone won’t suffice.

Expanding on the loan process example, end-to-end process automation can significantly improve the lending experience. While back-end automation can sift through member data, and assist with underwriting, processing, and funding via artificial intelligence, end-to-end automation can efficiently convey the correct message to the appropriate member at the right time, and compile all required documents without needing a credit union professional’s involvement.

Owing to its wide-ranging capabilities, end-to-end automation can interface between legacy systems and seamlessly transfer data across various systems that normally can’t communicate with each other. In such an environment, cutting-edge technologies like AI and cloud integration can provide a 24/7, highly personalized banking experience.

Undeniably, front-end technology is a positive stride for any credit union or financial institution aiming to refine its operations and member experience. However, credit union leaders should understand that an excellent member experience implies an all-encompassing experience from start to finish.

Each organization possesses unique strengths and weaknesses. Not all credit unions require the same tools or strategies. Hence, credit union decision-makers should scrutinize their unique processes, teams, members, and systems and implement solutions tailored to their specific needs. Credit unions should select tools capable of coordinating both front-end and back-end operations to collectively drive enriching member experiences.