Cosimo de’ Medici, the father of modern day banking, and in many respects a founder of the first bank, is celebrated this Sunday of 2021.

Born in Florence, Italy, in 1389, he’s likely known to you by way of the Medici name, given their influence in 14th – 17th century Italy during the renaissance that took place there and then (or, perhaps at least because of the resurgence of interest in the stories of the family, found played out in shows on Netflix). Less likely known is Cosimo’s life; that of an Italian banker and politician – it was he who established the Medici family and name.

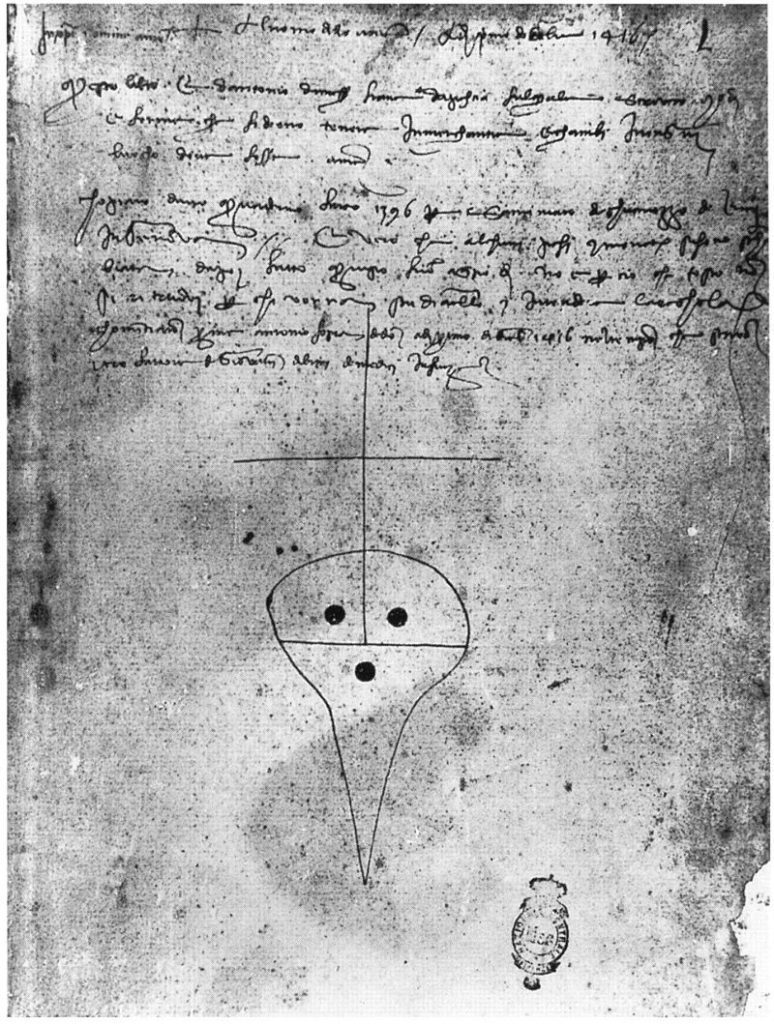

Cosimo inherited both his wealth and his expertise in banking from his father Giovanni, who had gone from being a moneylender to join an early bank, that of his relative Vieri di Cambio De Medici, in Rome. Giovanni, in 1397, left Rome to return to Florence and open the Medici Bank which, over the next couple dozen years, opened branches in Rome, Geneva, Venice, and Naples; it was this that was left to Cosimo, and his brother Lorenzo, to run.

It’s from this era, both the time of Giovani and of Cosimo, that modern finance was born and adopted, as the de Medici brothers grew the bank into Spain, England, and Belgium, worked with the Papacy and Church, and near single-handedly established banking beyond local money lending, into the networked organizations that manage money. We have Letters of Credit, Double-Entry Bookkeeping, and the Holding Company, thanks to the innovative and entrepreneurial minds of a family who should be considered the first to work in FinTech.

World Fintech Day

August 1 recognizes Cosimo’s passing and today is celebrated as World Fintech Day; last recognized in a virtual event last year.

Participating then, Brett King, The Godfather of the Fintech Mafia, Jo Ann Barefoot, CEO & Cofounder at Alliance for Innovative Regulation, Matteo Rizzi, Host of Breaking Banks Europe, Paolo Sironi, Bestselling author of Fintech Innovation and Financial Market Transparency, Theodora Lau, founder of Unconventional Ventures, were among some incredible speakers.

This is the time, August 1st and now, in general, to appreciate the impact and importance of our financial markets, banking and finance, and FinTech. As cryptocurrency, smart contracts, crowdfunding, and far more innovation continues to emerge, your relationship with money, and the software that enables all this, will evolve, globalize, and become much more personal. Our 21st century revolutions in banking will be as game changing as were the Medici’s in the 16th century, and what we do in finance, together, will have impacts as substantial as were theirs, in politics, the arts, and entrepreneurship.

Cosimo’s power was drawn from his wealth as a banker but his social impact was that of a patron of arts, learning, and architecture, thanks to his prudent mind and invention of new approaches with money. Over his lifetime, he spent nearly $500 million (inflation and currency adjusted of course) on culture and community, helping the world discover such works as Donatello’s David, as a patron of the arts.

While the internet and ushered us into a new renaissance in banking, it’s exciting to be part of a the more than 500 year history of FinTech.